Navigating the Atlantic Divide: Contrasting the UK and US Real Estate Markets

In terms of real estate, the differences between the United Kingdom and the United States go far beyond the evident architectural styles and accents. From changing market dynamics to unique property laws, each country has its own way of handling real estate investments and renting processes. With that in mind, here are some of the most notable distinctions between the UK and US property sectors:

Contents |

[edit] Market Structure and Regulations

The housing system in the UK is more centralised than in the US. British estate agents traditionally act as intermediaries between buyers and sellers, with available properties often being listed on centralised local platforms. Additionally, real estate transactions here generally involve conveyancers or solicitors to handle the legal aspects. The American housing market is more decentralised, however, with multiple listing services (MLS) being prominent in the industry. Real estate agents are important for facilitating transactions in the US, but the lack of centralised solutions means that sellers and buyers might have to work with several agents or platforms in order to find suitable properties. For that reason, many local experts believe it’s high time to regulate the real estate sector more closely.

[edit] Property Sizes and Styles

A significant difference in the real estate industry between the UK and US is the range of available property types and sizes. Across Great Britain, particularly in urban areas, units tend to be smaller and more compact than their American equivalents. Flats and terraced houses are common in cities such as London where space is a premium commodity. On the other hand, the USA can offer a wider range of housing options, including high-rise condominiums, roomy single-family homes, and sprawling estates. This diversity perfectly represents America’s huge landmass and different regional preferences, from New York’s charming brownstones to Texas’ ranch-style houses.

[edit] Rental Market Dynamics

The rental environment represents another important difference between the two nations’ housing landscapes. While rental sectors are booming in both the UK and the US, there are stark differences in tenant rights and rental practices. In Britain, occupants can rely on more extensive legal protections, such as strict regulations of eviction procedures and rent increases. Also, long-term leases are common in Great Britain, with many individuals choosing tenancies that last several years. In contrast, America provides a more dynamic rental environment with shorter lease terms and fewer regulatory constraints. States such as Florida provide a range of rental opportunities, including the wonderful St Petersburg FL apartments as well. These accommodation options are tailored to various lifestyles and inclinations, allowing every individual to find the perfect unit.

[edit] Financing and Mortgages

When it comes to purchasing property, financing options and mortgage structures also vary between the US and the UK. The USA provides a wide variety of mortgage products, such as interest-only loans and adjustable-rate mortgages (ARMs). The American market grants longer loan terms as well, with 30-year mortgages being the most common, giving homebuyers more flexibility in managing their monthly expenses. On the other hand, most buyers in Britain still rely on conventional repayment mortgages in which they slowly pay off both the principal amount and interest over the loan term. In addition, fixed-rate mortgages are standard here, offering individuals more predictable monthly payments.

[edit] Investment Opportunities

Investors looking to profit from real estate opportunities will notice differences between the US and UK landscapes, too. In Great Britain, buy-to-let units represent a popular investment option, driven by high rental demand and the potential for capital appreciation. However, regulatory changes such as stricter lending criteria and tax reforms have toned down the enthusiasm of British financial backers in recent years. Conversely, America offers a more agreeable investing environment, with a greater market size, varied property types, and excellent tax incentives. Furthermore, the resilience and innovation of the US market continue to attract both local and international investors searching for attractive returns.

In conclusion, while the UK and the US share some similarities in terms of property values and rental demands, significant differences exist in their real estate sectors, from market structure and financing options to property sizes and investment opportunities. Understanding these distinctions is crucial for buyers, sellers, tenants, and investors aiming to navigate the complexities of each housing sector and make informed decisions.

Featured articles and news

Inspiring the next generation to fulfil an electrified future

Technical Manager at ECA on the importance of engagement between industry and education.

Repairing historic stone and slate roofs

The need for a code of practice and technical advice note.

Environmental compliance; a checklist for 2026

Legislative changes, policy shifts, phased rollouts, and compliance updates to be aware of.

UKCW London to tackle sector’s most pressing issues

AI and skills development, ecology and the environment, policy and planning and more.

Managing building safety risks

Across an existing residential portfolio; a client's perspective.

ECA support for Gate Safe’s Safe School Gates Campaign.

Core construction skills explained

Preparing for a career in construction.

Retrofitting for resilience with the Leicester Resilience Hub

Community-serving facilities, enhanced as support and essential services for climate-related disruptions.

Some of the articles relating to water, here to browse. Any missing?

Recognisable Gothic characters, designed to dramatically spout water away from buildings.

A case study and a warning to would-be developers

Creating four dwellings... after half a century of doing this job, why, oh why, is it so difficult?

Reform of the fire engineering profession

Fire Engineers Advisory Panel: Authoritative Statement, reactions and next steps.

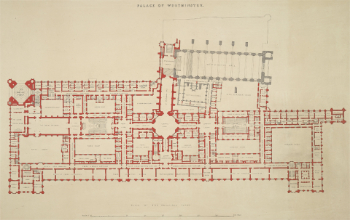

Restoration and renewal of the Palace of Westminster

A complex project of cultural significance from full decant to EMI, opportunities and a potential a way forward.

Apprenticeships and the responsibility we share

Perspectives from the CIOB President as National Apprentice Week comes to a close.

The first line of defence against rain, wind and snow.

Building Safety recap January, 2026

What we missed at the end of last year, and at the start of this.

Comments

https://www.designingbuildings.co.uk/wiki/Marketing_opportunities_on_Designing_Buildings

https://www.designingbuildings.co.uk/wiki/Editorial_policy

https://www.designingbuildings.co.uk/wiki/Page_about_me